Insurance as a therapist has the advantages of increasing the population’s availability and stability of income. One of the many resources used by patients seeking therapy is insurance, which means that therapists need to acquaint themselves with credit and reimbursement procedures tied to insurance participation.

There are several challenges associated with implementing insurance in therapy practice; such as credentialing, filing of claims and following other necessary standard procedures. Below is a step-by-step guideline on how to accept insurance as a masseuse; credential, what the massage therapist needs to do and consider concerning payments.

Understanding Insurance for Therapists

There are different types of insurance that therapists may accept or prescribe which include private insurance companies, Medicaid, Medicare and EAPs. Policies of coverage and tariffs of reimbursement also depend on the choices of a particular provider and on state laws. The general difference between in-network and out of network is as follows:

- There are contracted relationships with the insurance company and have an expectation with respect to the amount to be charged for the services rendered. Patients are also admitted to spend lower amounts of their own pocket.

- Out of network providers are those who do not have a clause with the insurance firms hence requiring the clients to seek reimbursement on their own.

The laws regulating mental health insurance require insurance companies to treat mental health services like any other physical health services which makes therapy more accessible.

Credentialing with Insurance Companies

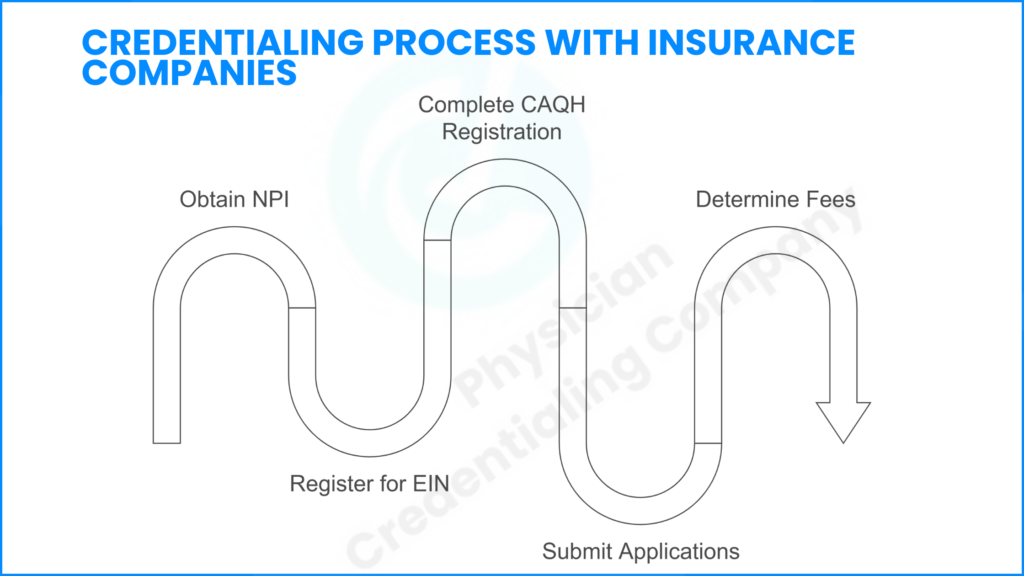

In order to accept insurance, practicing therapists are required to go through a credentialing process, which more or less confirms their license, qualification, and experience.

Steps to Obtain Credentialing

- Obtain a National Provider Identifier (NPI): Insurance billing cannot be done without this identifier.

- Register for an EIN: If one is planning to open the practice alone he or she will need an EIN for the practice for taxation and billing procedures.

- (CAQH): CAQH is an online source that makes it effortless to get credit with numerous insurance companies. Complete the registration process for the Council for Affordable Quality Healthcare.

- Submit Applications for Insurance Panels: Memberships with insurance firms like Blue cross and blue shield, Aetna and Cigna.

- Determination of Fee and Billing Procedures: Therapist reach an understanding with payers over fee structures and billing practices by completing all necessary paperwork put forward.

Credentialing can take up to a maximum of six months but it may take between three months depending with the organization. Writing down records and following insurer requirements is very crucial to ensure that the process is as effective as possible.

Establishing an Efficient Insurance Billing System

When one becomes licensed, he or she must conduct an effective billing process with regard to insurance claims and payments.

- Electronic Health Records (EHR) System: Several applications like SimplePractice and TherapyNotes are appropriate for recording clients’ information and generating bills.

- Billing Services or Software: Sometimes the therapist works independently in billing services while in other cases, they contract outside billing services.

- Payment Polices: Several polices should be developed to include co-payment, deductible and out of pocket expenses.

Clients’ failure to complete interviews, incorrect codes on CPT, incomplete details on clients, and failure to file the claims at the right time can lead to claim denials which us why documentation is very essential.

Steps for Insurance Claims Submission

The cost of PT entails many expenses depending the place where the treatment happens. The average costs are:

- Possibility of Insurance: The client’s insurance plan must be ascertained to compare, co-payment, and restrictions for coverage before a session can take place.

- Documentation Requires the Appropriate CPT Codes, where by Current Procedural Terminology or CPT codes are used for billing purposes such as code 90837 that represents a therapy session that takes 60 minutes.

- Disbursement of Claims: Insurance firms always encourage the submissions of claims through electronic means as they take less time.

- Claim Tracking: Check on the status of the claims so as to make follow-ups on the reimbursement approvals.

- Receiving a Claim Denial In the course of their claims, one may receive a refusal which is based on certain reasons that they need to remedy so that they can resubmit the claim.

Read about the cost of therapies without having an insurance!

How to Accept Insurance as a Massage Therapist

Insurance acceptance is one of the significant issues that massage therapists face since they differ from state to state or from one health insurer to another based on medical necessity. An NPI number and/or identity and address at least licensure requirements then a few insurance carriers providing coverage for massage therapy must accept the credentialing of massage therapist.

How to Accept Health Insurance as a Massage Therapist

In order to use health insurance as a massage therapist, there are certain things that one needs to meet as follows:

- Securing of referrals from the healthcare providers whenever needed.

- Businesses using massage and manual therapy should use correct CPT code namely 97124 and 97140 respectively in order to support the claims.

- Натпaylor is knowledgeable about the restrictions that insurance policies may impose on massage therapies and conveys them to the clients.

Regarding reimbursement, there are factors with respect to medical necessity, individual providers, and insurance limits imposed on this sort of service.

Understanding Insurance Reimbursements

When a person is covered by an insurance, different processes that should be followed before the insured is reimbursed depend on the insurance firm. Reimbursements usually take between 30 and 90 days from the date on which the claim has been made and approved. The therapists especially should ensure that they monitor the reimbursements, balance the payment and deal with any balances which may be remaining in order to ensure that they achieve a stable financial position.

Insurance companies can discuss with therapists about reasonable charges of service delivery for an individual to be paid appropriately.

Managing Co-Pays, Deductibles, and Client Payments

Such a plan requires that therapists accepting insurance insurance coverage explain financial liabilities to the client. Regarding insurance policies, there are co-payments, deductibles, and out-of-pocket spending for which clients bear costs.

Best Practices for Managing Client Payments

- Communicate Benefits Before Sessions: It is also important to check client responsibility amounts before appointments.

- Collect Co-Pays at Time-of-Service: The best method of dealing with any humanities is to eliminate them from arising in the first place or at least delay their occurrence in order to minimize them to the barest minimum in any circumstance.

- Automated Billing Systems: Instead of using traditional, paper bills and invoices, we ought to adopt hi-tech invoicing systems which reduces time wastage.

So as to avoid cases of misunderstanding in payment, it is important to outline good payment policies.

Legal and Ethical Considerations in Insurance Billing

Any insurance practice or acceptance thereof must be in strict compliance with the legal and ethical provision on insurance.

Key Considerations:

- HIPAA Compliance: This is because the personal information of clients’ needs to be protected by the therapist all the time.

- Ethical Billing Relations: Billing for services, which has not been offered is a fiction.

- Insurance Frauds: Therapists should avoid billing insurance for false practices, and only claim accurate practices that personal insurance will cater for.

For ethical practice and ultimate avoidance of legal repercussions, it is important to strictly follow the provisions of the law.

Advantages and Challenges of Accepting Insurance

Benefits

- Increased client access to therapy services.

- Consistent revenue stream.

- The reach to more insurance networks to refer patients with disorders in order to seek professional mental health services.

Challenges

There is more constriction of Audi revenue because there is lower reimbursement rate compared to private pay clients.

- Extensive administrative responsibilities.

- Delayed payments from insurance providers.

Such factors must be looked at when the therapists are considering which insurers they will work with.

Alternatives to Accepting Insurance

Some of the other payment methods available for clinicians who do not participate in health insurers’ panels include:

- Sliding Scale Fees: Having flexible charges depending on the finances of the client.

- Superbills for Out-of-Network Reimbursement: Preparation of super bills for the clients to claim the reimbursement directly from insurance companies.

- Trade Credit: Jointly putting together with the financial institutions who are willing to offer payment terms.

These advisory options can be used to support the therapists to implement flexibility to meet the needs of their different clients.

Enhancing the Insurance Billing Process

Some ways that therapists should proceed in order to enhance billing:

- Claims Application Automation: Minimizes on human-interface to avoid errors in the submission of the claim.

- Keep Abreast with new Insurance Policies: New insurance policies can infringe on the amount given as compensation.

- Choose Professional Billing Help: Since billing issues can be complex and time-consuming, it is advisable to outsource this function.

The use of these approaches lead the therapists can be able to work effectively in worrying insurance billing manner.

Conclusion

Insurance reimbursement as a therapist isn’t straightforward and involves matters such as credentialing, filing, and reimbursement. As the wheel of business increases the reach of its clients and brings financial solidity, it also includes a good deal of administrative burden. Insurance acceptance should always be evaluated according to the needs and aspirations of a practicing therapist before considering their practice’s contingencies.

FAQ - People Also Asks

How to get credentialed with insurance as a therapist?

Therapists have to make use of the NPI number, join the CAQH and apply for insurance panels. This occurs in several months because one has to go through the selling of the product and getting back to the customers for their feedback, among other procedures. Read the process for Physical Therapist and Mental health here.

Is it normal for a therapist to not accept insurance?

Indeed, some therapists work under the private-pay settings because of the complexities of billing and lower pay.

Why it is so hard to find a therapist that takes my insurance?

Lack of insurance, long credentialing time, and monetary issues are among the reasons that influence the scarcity of therapist acceptance to insurance.

What does it mean when a therapist accepts your insurance?

It simply implies that the therapist has the Insurance Provider Code which enables them to submit bills for claim for services that are in the client’s policy.